Post #3: Do Interest Rates Really Matter for Tech Stock Values?

Not directly, but the factors that influence interest rates will impact how highly (or not) growth stage tech companies are valued by public & private investors.

Interest rates have rarely been a significant concern for tech startup founders. Frankly until last year, few people have thought about them much given the US Fed Funds rate has been near 0% of the vast majority of the prior 15 years.

Conventional wisdom is that higher interest rates are generally bad for tech stocks. But if you look at the evidence over the last 30+ years though it’s actually not so cut and dry. The Internet 1.0 boom/bubble that occurred in the latter half the 1990s took place when the US Fed Funds rate was in the 5-7% range and rates were generally rising in 1998-1999. After big losses in 2022 as rates started rising, here in 2023 megacap tech companies like Microsoft, Apple, Tesla, NVIDIA, etc have seen 40-50%+ gains when the rest of the S&P 500 is basically flat YTD.

So what gives?

Rates Go Up, Rates Go Down

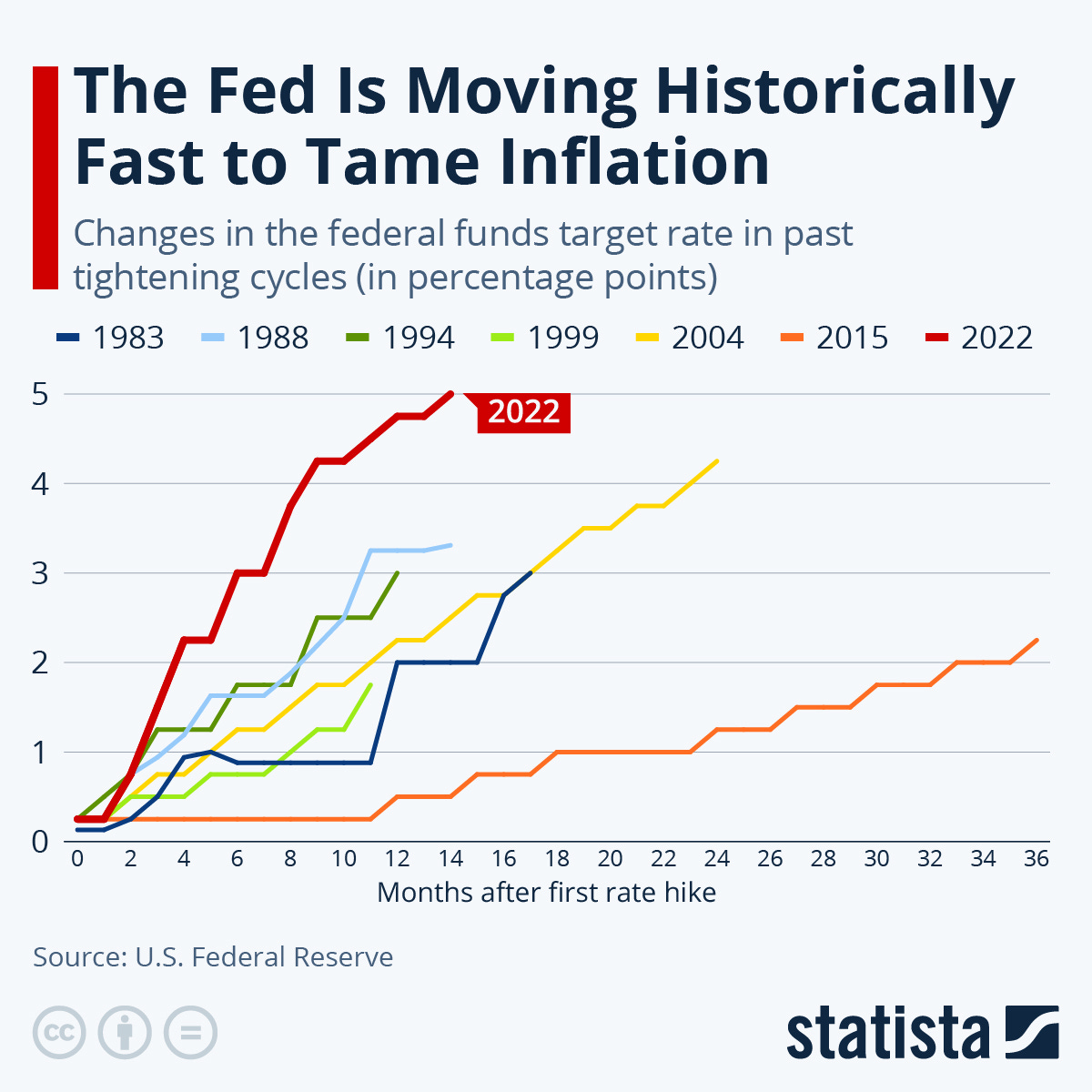

As most folks know, over the course of the last 15 months the US Federal Reserve has increased interest rates faster than any other time in history to reign in runaway inflation that peaked at nearly 10% in 2022. It’s also rapidly shrinking the money supply (via quantitative tightening) at the same time. But core inflation is proving fairly sticky and remains ~5%, so it’s unlikely the Fed Funds rate will be reduced anytime soon barring a crippling recession. Even with the rapid hiking in 2022, the real (inflation adjusted) interest rate has remained negative until now.

Over the intermediate term (months/years), inflation and employment end up being the main drivers of rates. Over the very long term (decades), demography, geopolitics, and overall levels of debt come into play more sharply for interest rates… a topic for a future post.

Valuing Tech Companies

Tech businesses ultimately get valued by investors based on their own intrinsic metrics like revenue growth, gross margins, and profitability as well as qualitative factors like competitive moat or brand strength. Startups and less mature public companies are often analyzed with revenue multiples (aka price to sales) instead of earnings (PE multiple), given they are often not yet profitable or only modestly profitable and typically still investing heavily in a high growth mode.

Revenue multiples for most of the last decade for emerging software companies have been in the 6-10x range. The exception was the “Everything Bubble” which occurred mid 2020 through the end of 2021. Public tech companies were trading at 15-25x revenue multiples and private companies were often being valued at 50-100x current sales (20-30x+ projected forward revenues). The reset to 6-10x in 2022 isn’t the anomaly… it was reversion to the long run mean.

Again conventional wisdom is that higher interest rates are bad for risky assets like tech stocks. In finance textbooks this is true, as a higher discount rate means future cashflows (like the future profits of a growth stage tech company) are worth less in present value. Ask ChatGPT about “discounted cash flows” to learn more.

Correlation vs Sensitivity

There are parts of the economy that are highly sensitive to changes in interest rates… capital intensive sectors like real estate or mining / natural resources. Debt is like oxygen for these industries, so when debt becomes more expensive and less available the metabolic rate of these businesses slows dramatically.

Tech companies rarely use substantial debt for growth, so changes in interest rates or the availability of debt have negligible effects on most tech businesses. Tech isn’t “interest rate sensitive” in the traditional sense. But tech valuations are ultimately correlated to the factors that cause changes in interest rates from inflation to employment to GDP growth. And demand for the stocks of tech companies, whether publicly traded or private investments by VCs and angels, is impacted by changes in the rate of return for other assets caused by increasing interest rates.

Asset Allocation & Investment Flows Matter

Investors demand a higher potential return on risky assets like tech stocks over the “risk free” rate on US government bonds. All else equal, the higher the risk free rate goes then the lower the price of particular tech stock would have be to produce a higher expected return over time. Ask ChatGPT about the “capital asset pricing model” to learn more.

When nominal returns on US government bonds were near 0% and the Federal Reserve was a massive net buyer of these securities (quantitative easing), as was true prior to 2022, investors sought out other asset classes that provided >0% returns. Investors large and small bought higher risk assets like public and private tech companies en masse.

A crude simplification of this is the fund flows for the ARK Innovation ETF, the green bars showing a spike of new investment in ARKK followed by the red outflows starting at the end of 2021. At the same time interest rates climbed rapidly, and the US Treasury saw a 5x increase in the number of accounts for TreasuryDirect which let individual investors buy government bonds.

Where Now From Here?

The Federal Reserve may pause their interest rate hikes today, and whether they pause here at the June 2023 meeting or not, in all likelihood rates won’t be increased a lot from here. But if core inflation remains well above the Fed’s 2% target, we’re likely to see moderate to high interest rates for awhile… the “higher for longer” narrative.

So it’s unlikely we’ll see a return to the revenue multiples of 2020-2021 in tech again anytime soon. But that doesn’t mean changes in investor appetite for tech and asset allocation flows can support demand for tech companies. We’re seeing that right now with megacap tech companies as well as a narrow segment of private companies (AI focused startups).

So everyone in tech startups and VC has to plan for a phase where revenue multiples look like they have for most of the pre 2020 era, where only the very best companies might command a 10x+ multiple and average companies are below that. But the higher rate environment, even if it persists for years to come, needn’t necessarily be a portent of a long dark period for tech.